About Agent Credit

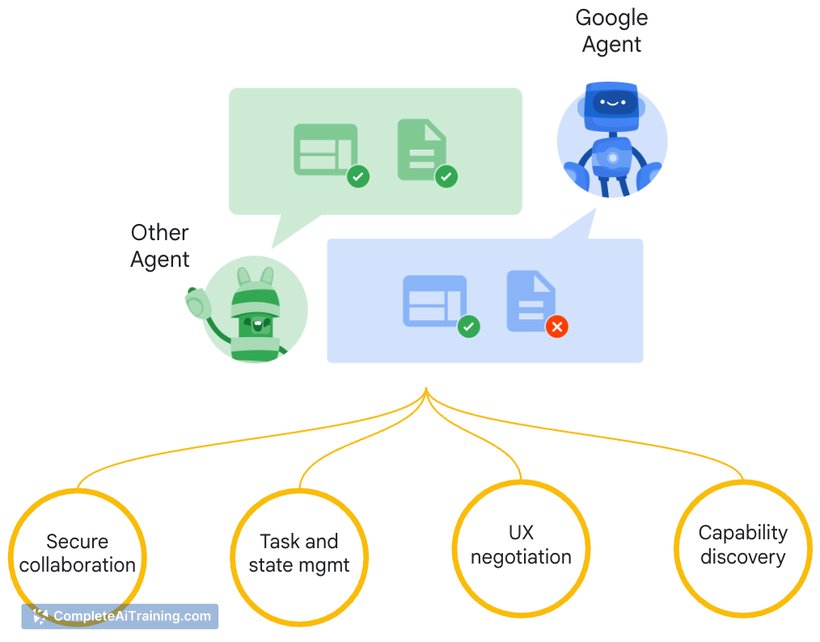

Agent Credit offers the first credit line specifically for autonomous agents, enabling them to borrow and repay funds via Aave. The service aims to let agents cover API calls, transaction fees, and other operational costs without constant manual top-ups.

Review

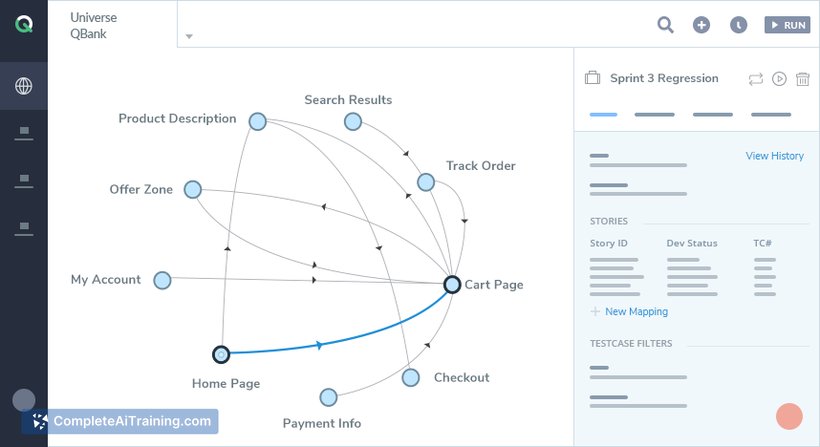

Agent Credit introduces a practical approach to financing agent activity by tying lending to a well-known protocol. Its core value is enabling agents to operate more autonomously, but the concept raises important questions around risk management and smart contract safeguards. As an early-stage offering with a public code presence, it will appeal to builders willing to test new agent financing workflows.

Key Features

- Aave-backed credit lines that agents can borrow from and repay programmatically.

- Agent-driven payment flow for API usage and on-chain transaction fees.

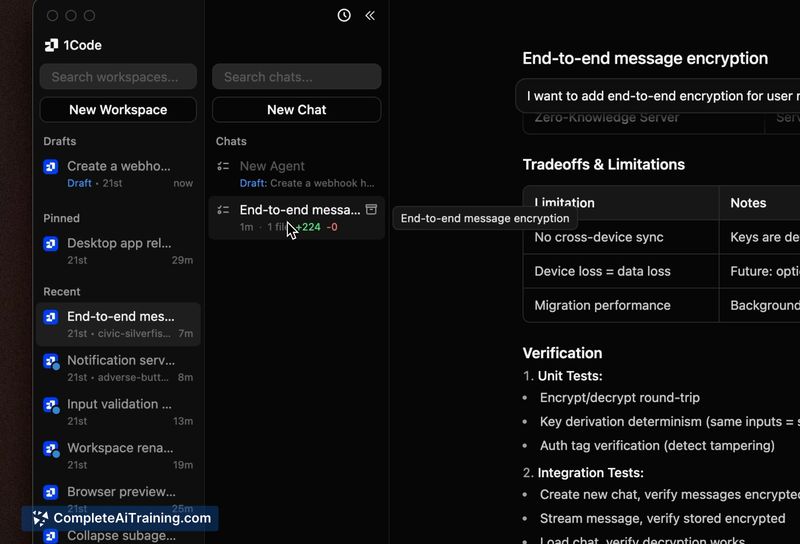

- Integration fit for Web3 agents with a public code repository for review and contribution.

- Minimal friction onboarding for experiments and prototyping (free to start).

Pricing and Value

Agent Credit is listed as free to start, with its fundamental value proposition being reduced manual maintenance of agent wallets and smoother autonomous operations. The real value depends on how the product balances access to credit with safeguards like collateral rules, liquidation protections, and audit quality. For teams experimenting with agent workflows, the cost of entry is low, but production adoption should factor in risk and compliance overhead.

Pros

- Makes continuous agent operation more practical by removing frequent manual top-ups.

- Leverages an established lending protocol, which can speed integration and liquidity access.

- Open development model via GitHub, which helps with inspection and community feedback.

- Low barrier to try for developers and researchers exploring agent-led automation.

Cons

- Unclear details around collateralization, liquidation handling, and owner exposure to risk.

- Early-stage project with limited community size and potentially sparse documentation or audits.

- Regulatory and security considerations could complicate production deployments.

Agent Credit is best suited to developers and teams building autonomous agents who want to prototype financing strategies or reduce manual maintenance. Caution is warranted for critical production systems until the protocol's risk controls, documentation, and security reviews are more mature.

Open 'Agent Credit' Website

Your membership also unlocks: