6 Essential AI Courses for Insurance Data Analysts in 2025

Discover the top 6 AI courses poised to transform insurance data analysis by 2025. Learn cutting-edge techniques to enhance your skills, improve accuracy, and stay ahead in the evolving insurance landscape. Perfect for data analysts aiming for a tech-driven edge.

As artificial intelligence (AI) continues to advance, its influence on various industries is undeniable. For insurance data analysts, staying ahead of these technological developments is not just beneficial—it's essential. The integration of AI in insurance is reshaping traditional roles, demanding professionals to upskill to remain competitive in the dynamic job market. With AI's potential to automate complex tasks, enhance decision-making, and improve customer experiences, insurance data analysts who embrace AI technologies are positioned to excel in their careers and drive innovation within their organizations.

Why AI matters for Insurance Data Analysts today

AI's significance in the insurance sector is more apparent than ever. As of recent statistics, 69% of businesses have integrated AI into their operations, underscoring its transformative impact. For insurance data analysts, AI is not just a buzzword—it's a critical tool that enhances efficiency and productivity. This article serves as a guide for insurance data analysts looking to identify the best AI courses that can equip them with the skills needed to thrive in this evolving landscape.

The Growing Role of AI in Insurance Data Analysts

AI applications are becoming integral to the insurance industry, offering solutions that were once unimaginable. Automation of routine tasks, enhanced decision-making processes, and personalized customer interactions are just a few examples of how AI is changing the game for insurance data analysts. By leveraging AI, professionals in this field can streamline workflows, reduce operational costs, and deliver more accurate insights, ultimately providing better service and value to clients.

Benefits of becoming an AI expert in Insurance Data Analysts

For insurance data analysts, gaining expertise in AI offers numerous advantages. It not only enhances career opportunities but also increases job security in a tech-driven environment. AI proficiency allows analysts to take on more strategic roles, contribute to significant business decisions, and become pivotal in crafting data-driven solutions. Moreover, AI expertise enables analysts to anticipate market trends, adapt to changes promptly, and innovate by developing new products and services tailored to customer needs.

This article will compare six AI courses specifically designed for insurance data analysts, including the CompleteAI Training, which offers a comprehensive library of video courses and certifications tailored to this profession. By exploring these options, insurance data analysts can find the right course that aligns with their professional goals and helps them leverage AI to its fullest potential.

Comparison: All AI Courses for Insurance Data Analysts (Updated Q2' 2025)

| Course Name | Provider | Price | Key Topics | Pros | Cons | Best For |

|---|---|---|---|---|---|---|

| AI for Insurance Data Analysts | CompleteAI Training | $29/month or $8.25/month billed annually | Specialized video courses, AI tools, Industry news | Highest rating, Extensive courses, Daily updates, Affordable | Subscription based | Insurance Data Analysts professionals |

| Introduction to Data Science and AI for Insurance (2025) | Chartered Insurance Institute (CII) & Southampton Data Science Academy | $1,440 for members, $1,800 for non-members | Data tools, Analysis, Visualization, Ethical AI | Tailored for insurance, Ethical considerations, Interactive | Price, Requires commitment | General learners |

| AI Certification for Data Analysts | Techcanvass | $173 (10% early bird discount available) | AI integration, Automation, Visualization | Boost productivity, Enhance accuracy, Career growth | Short duration, Certification recognition | General learners |

| Associate in Insurance Data Analytics (AIDA) | The Institutes | Approx. $1,500,$2,000 | Insurtech, AI, Data ethics, Decision-making | Comprehensive curriculum, Flexible, Recognized designation | Higher cost, Longer duration | General learners |

| Data Analytics with Python and Generative AI | Nanyang Business School, NTU | $2,190 per module | Data wrangling, Visualization, Text analytics | Industry-relevant, Hands-on, Flexible | Own laptop required, Programming background recommended | General learners |

| Insurance Domain Training | Techcanvass | Contact provider for pricing | Insurance sector knowledge, Regulatory context | Crucial domain knowledge, Enhances AI skills | Not standalone, Pricing not specified | General learners |

Understanding AI Training for Insurance Data Analysts Professionals

As the insurance industry increasingly integrates advanced technologies, the role of AI in transforming data analysis is becoming more significant. Insurance Data Analysts need specialized training to leverage AI tools effectively and stay competitive. This article compares several AI training courses tailored for these professionals, highlighting their unique features, pros, and cons to help you make an informed decision.

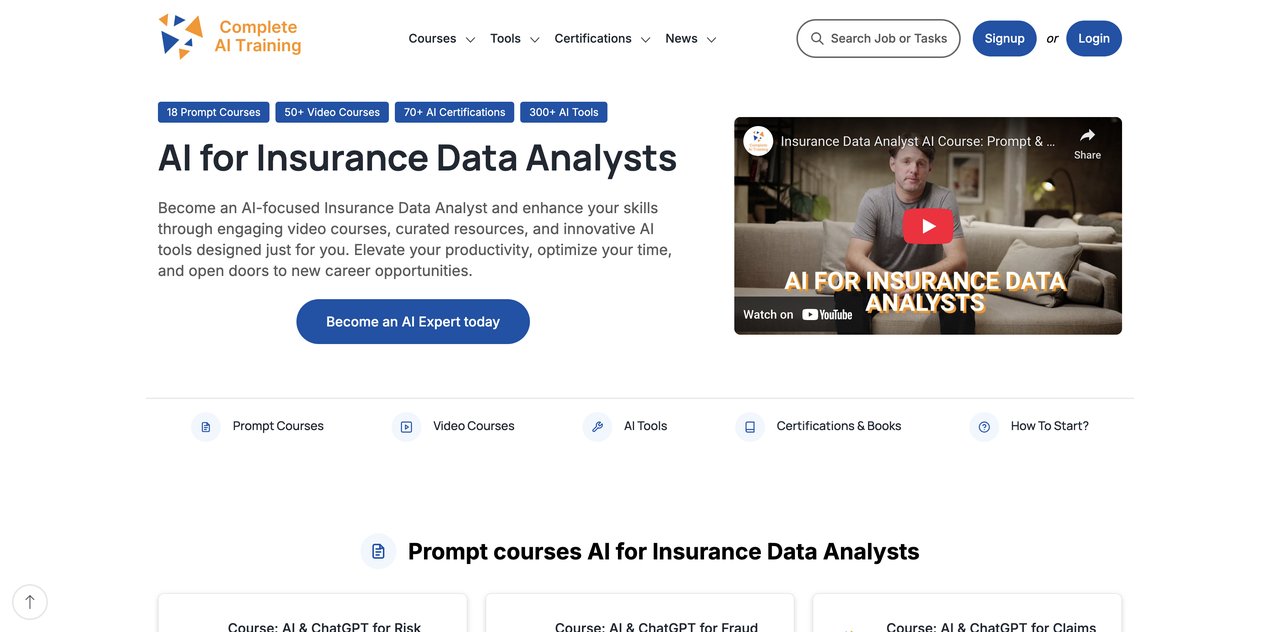

Course 1: CompleteAI Training

CompleteAI Training offers a comprehensive library of over 100 video courses and certifications specifically designed for Insurance Data Analysts. The platform provides subscribers with daily updates on AI tools and curated news relevant to the industry, ensuring that learners remain updated on new developments.

Key Topics Covered: AI education, latest AI tools, industry news

Target Audience and Skill Level Requirements: Insurance Data Analysts, suitable for all skill levels

- Pros:

- Highest rating and most complete offering for Insurance Data Analysts

- Extensive range of courses and certifications

- Daily updates on relevant AI tools and news

- Affordable pricing, especially with annual billing

- Cons:

- Subscription-based model requires ongoing payments

Who Would Benefit Most: Insurance Data Analysts seeking a comprehensive and continuous learning experience at an affordable cost.

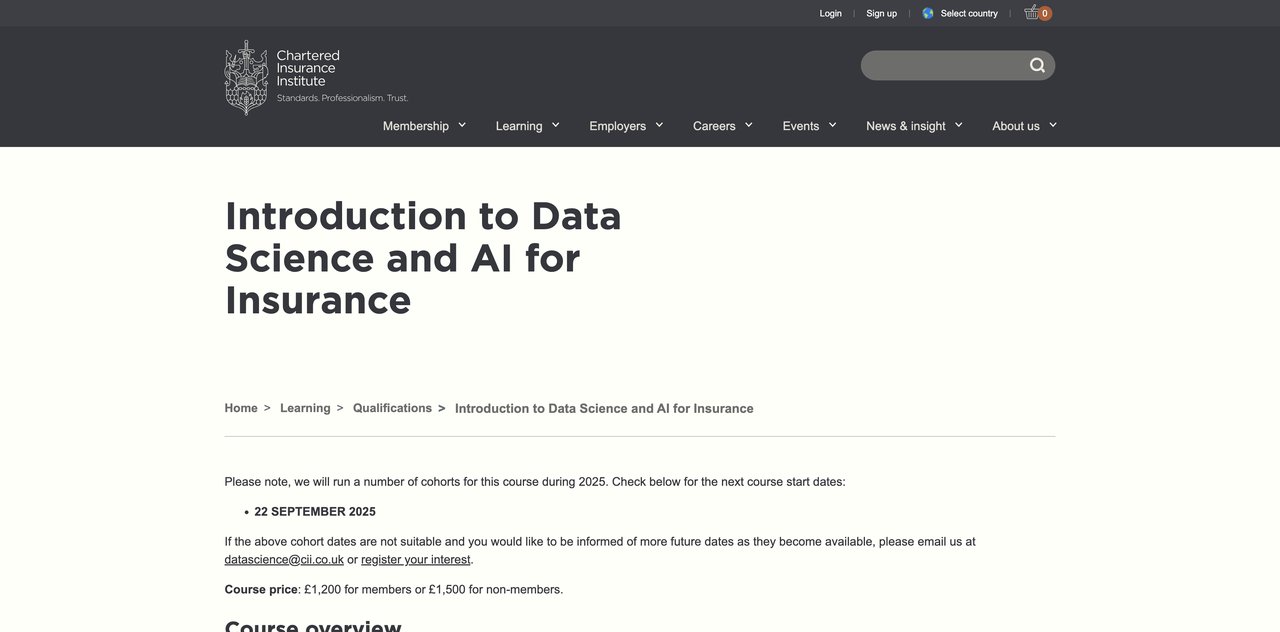

Course 2: Introduction to Data Science and AI for Insurance (2025) by Chartered Insurance Institute (CII) & Southampton Data Science Academy

This course is an introductory-level program that equips insurance professionals with foundational knowledge in data science and AI as applied to insurance. It covers a range of topics including data tools, analysis, visualization, and ethical AI use, aiming to enhance skills in risk assessment, pricing, and fraud detection.

Key Topics Covered: Data tools, analysis, visualization, ethical AI use, risk assessment

Target Audience and Skill Level Requirements: Insurance professionals, beginners

- Pros:

- Specifically tailored for insurance professionals

- Covers ethical and legal considerations of AI

- Interactive learning methods

- Recognized certification and CPD credits

- Cons:

- Higher cost might be a barrier

- Commitment to scheduled tutorials required

Who Would Benefit Most: Beginners in the insurance industry who need a structured introduction to data science and AI.

Course 3: AI Certification for Data Analysts by Techcanvass

Techcanvass offers a comprehensive course aimed at integrating AI into the workflows of data analysts. The curriculum includes AI-driven data preparation, visualization tools, and automation, culminating in a capstone project. It provides an industry-recognized certification co-branded by IIBA Canada and Techcanvass.

Key Topics Covered: AI-driven data preparation, visualization tools, automation

Target Audience and Skill Level Requirements: Data analysts, suitable for all levels

- Pros:

- Enhances productivity by automating data tasks

- Reduces manual errors with AI-powered processing

- Fast insights with AI-driven visualizations

- Suitable for professionals with or without prior AI experience

- Cons:

- Short course duration (8 hours)

- Certification recognition may vary

Who Would Benefit Most: Data analysts seeking to integrate AI into their daily tasks and improve efficiency.

Course 4: Associate in Insurance Data Analytics (AIDA) by The Institutes

This designation program is designed for insurance data analysts and risk management professionals. It covers Insurtech, AI, data ethics, and data-driven decision-making, providing a comprehensive curriculum with core and elective courses, ethics training, and digital badges.

Key Topics Covered: Insurtech, AI, data ethics, decision-making

Target Audience and Skill Level Requirements: Insurance data analysts, intermediate to advanced

- Pros:

- Comprehensive curriculum

- Covers AI and Insurtech in insurance

- Flexible online learning with exam prep materials

- Industry-recognized designation

- Cons:

- Higher total cost due to multiple courses and exams

- Longer duration (6,9 months) may not suit all learners

Who Would Benefit Most: Intermediate and advanced professionals seeking a comprehensive program with a recognized designation.

Course 5: Data Analytics with Python and Generative AI by Nanyang Business School, Nanyang Technological University (NTU), Singapore

This program provides hands-on training using Python and Generative AI for insurance professionals and data analysts. It includes data wrangling, visualization, text analytics, and AI governance, using real insurance datasets for practical learning.

Key Topics Covered: Data wrangling, visualization, text analytics, AI governance

Target Audience and Skill Level Requirements: Insurance professionals and data analysts, programming background recommended

- Pros:

- Practical training with real datasets

- Integration of Generative AI tools

- Flexible module attendance

- Cons:

- Higher cost for international participants

- Participants need their own laptops

Who Would Benefit Most: Data analysts with a programming background looking for practical, hands-on experience with AI tools.

Course 6: Insurance Domain Training by Techcanvass

This training focuses on the insurance sector, providing essential domain knowledge and regulatory context. It complements AI and data analytics skills, making it ideal for data analysts working in or targeting the insurance industry.

Key Topics Covered: Insurance domain knowledge, regulatory context

Target Audience and Skill Level Requirements: Data analysts in the insurance industry, all levels

- Pros:

- Enhances relevance of AI/data analytics skills

- Provides crucial industry knowledge

- Can be combined with AI certifications

- Cons:

- Not a standalone AI course

- Pricing not explicitly stated

Who Would Benefit Most: Data analysts seeking to deepen their understanding of the insurance industry.

Overall Recommendations

Each of these courses offers unique benefits tailored to specific needs in the insurance data analytics field. CompleteAI Training is recommended for those seeking a wide-ranging and continuous learning experience at an affordable price. For beginners, the CII & Southampton Data Science Academy course provides a strong foundational understanding with recognized certification. Intermediate and advanced professionals might find the AIDA program by The Institutes a valuable choice for a comprehensive, career-focused curriculum. Those looking for hands-on experience with Python and AI tools may be interested in NTU's program. Ultimately, the best choice depends on your current skill level, career goals, and budget considerations.